GZC Intel & Research

Oil Intel Playlist

Market Reports

Contact us

-

Vincent

- September 11, 2023

- 10:25 am

Oil Intel

OPEC+ cuts are working but for how long?

OPEC+ faces a very challenging situation, requiring either a significant increase in global oil demand or a sharp decline in non-OPEC production to bring their spare capacity back into the market. However, the likelihood of either of these scenarios occurring is low. Consequently, it appears improbable that OPEC+ will have the opportunity to utilize its existing spare production capacity in the foreseeable future.

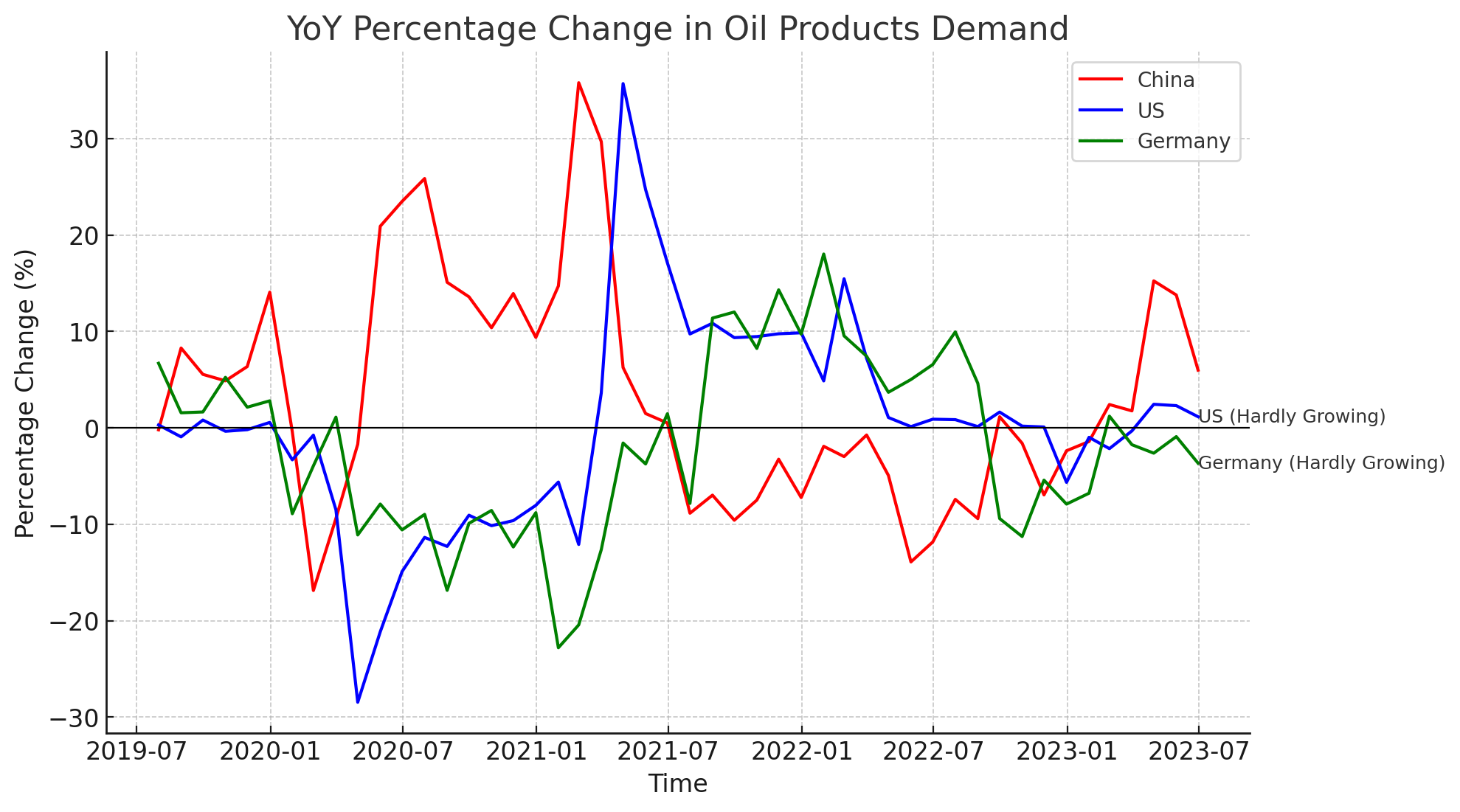

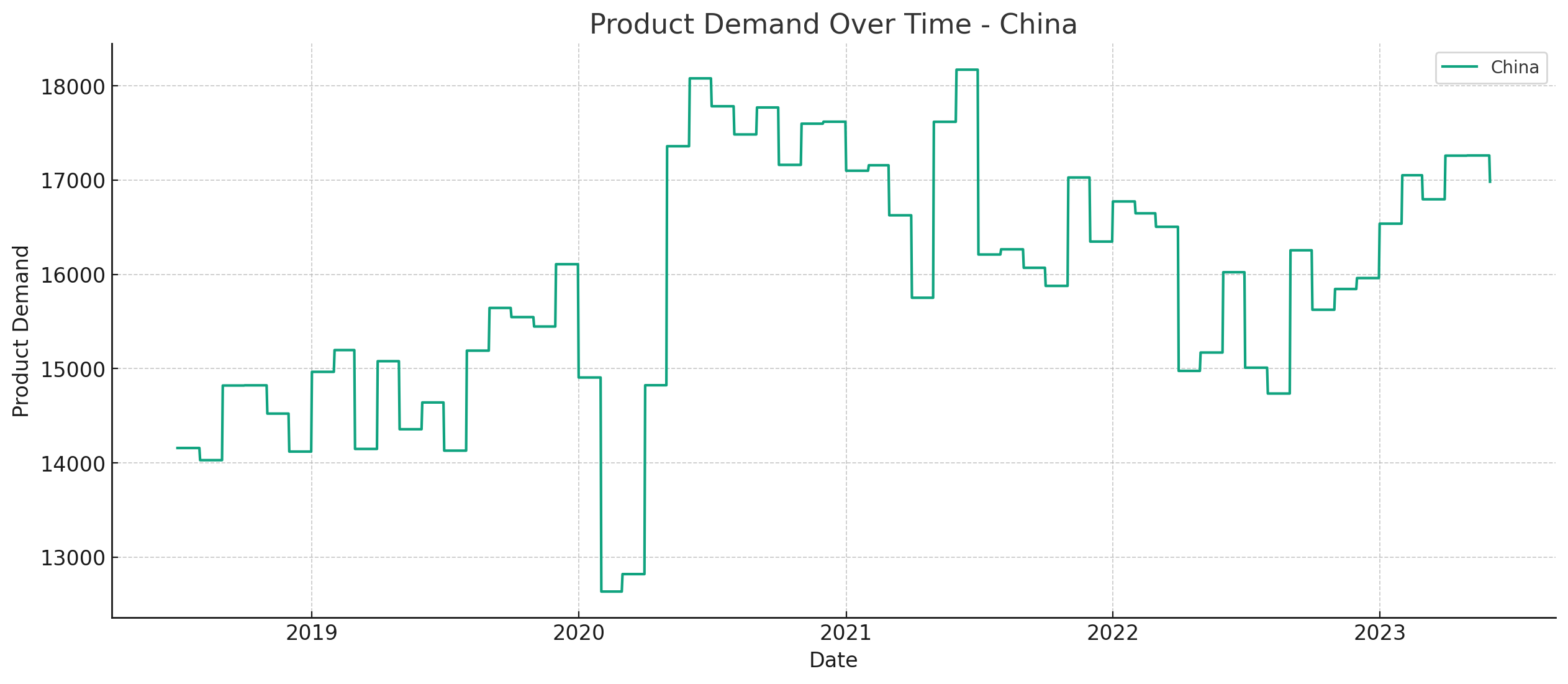

Year-on-year, global oil product demand growth currently stands at approximately 2.2 million barrels per day (Mbd). Historically, this represents a substantial increase in demand. However, when we examine China’s year-on-year demand growth, it is about 2 Mbd. This implies that the rest of the world, excluding China, has seen minimal growth in oil demand over the past year, despite strong economic activity and on-shoring trends. It’s worth noting that China alone accounts for 90% of the demand growth this year, compared to 50 to 70% before the COVID-19 pandemic.

Assuming a soft landing, as suggested by the market consensus, it’s reasonable to expect similarly limited demand growth outside of China in the coming year, essentially non-existent. Therefore, the focus shifts to forecasting Chinese demand over the next 12 months.

On one hand, there is potential for increased international travel, which could result in an additional 300-500 Kbd in demand. On the other hand, some of the pent-up demand related to COVID-19 may subside, suggesting that the post-COVID effects are largely behind us. Consequently, China is likely to align more closely with its historical relationship to GDP.

In the period from 2015 to 2019, a 6.5% annual GDP growth in China corresponded to a 500 Kbd increase in oil demand per year. If we assume that China achieves its official 5% GDP growth target, it suggests a demand growth of approximately 380 Kbd for the coming year. However, if we account for some decarbonization effects, which were less prominent in the 2015-2019 period, an additional 350 Kbd of oil demand from China would be quite remarkable. Overall, this leaves global demand growth at around 500 Kbd.

On the supply side, non-OPEC oil production is currently increasing at a rate of 1 to 1.5 Mbd and is expected to continue doing so in 2024-25. In other words, supply is likely to gradually outpace demand by 0.5-1 Mbd annually under a central soft landing scenario. In a worst-case hard landing scenario, where oil demand contracts by 2.5 Mbd, there could be a surplus of at least 3 Mbd in the market. Even with the best possible cooperation within OPEC+, it’s improbable that the group could implement cuts of such magnitude. In an extreme scenario, OPEC+ might manage to cut another 0.5 to 1 Mbd, at best neutralizing the soft landing scenario and postponing the surplus problem to 2025.

Additionally, some OPEC producers, like the UAE and Iraq, have ambitious production targets and may find prolonged production constraints untenable. There’s also the unique case of Iran’s return to the official export market, with Tehran aiming to export an additional 500-800 Kbd of crude oil in the next six months.

In summary, the combination of ample spare capacity within OPEC+, favorable prices for non-OPEC producers, sluggish demand growth, and potential discord among key OPEC producers suggests that oil prices are likely to normalize lower, approaching pre-summer rally levels around $75 per barrel. In the event that the soft landing scenario deteriorates into a hard landing, prices could decline further, potentially compelling non-OPEC producers to cut their production, but this action would likely only be triggered if prices fall below $50 per barrel.

-

Vincent

- September 11, 2023

- 10:25 am

-

Vincent

- July 19, 2023

- 9:35 pm

Oil Intel

Oil demand growth likely to soften sub +1% YoY soon

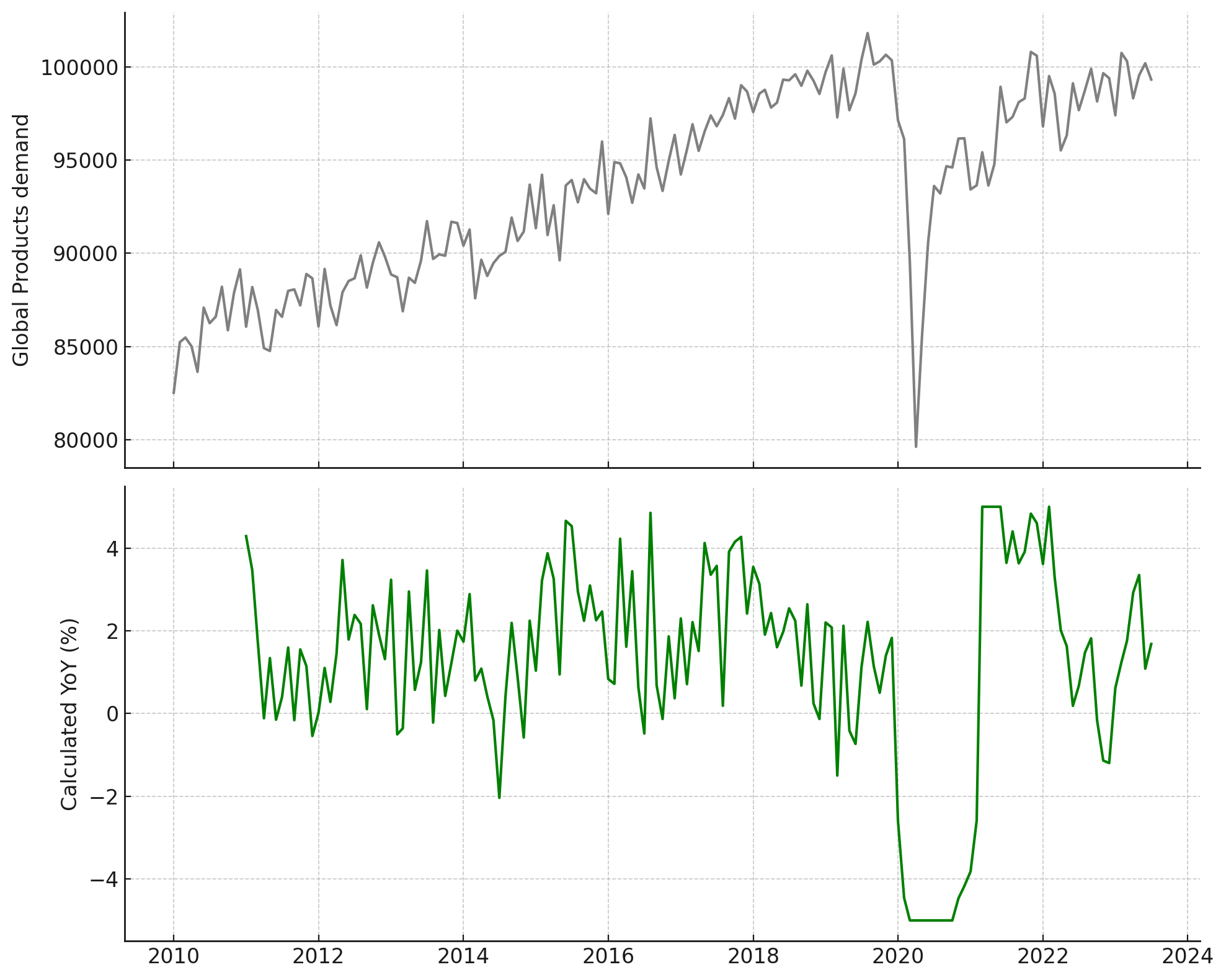

One can see that demand is already rolling over since april-may 23 (extremes YoY measures during covid have been removed in the above chart)

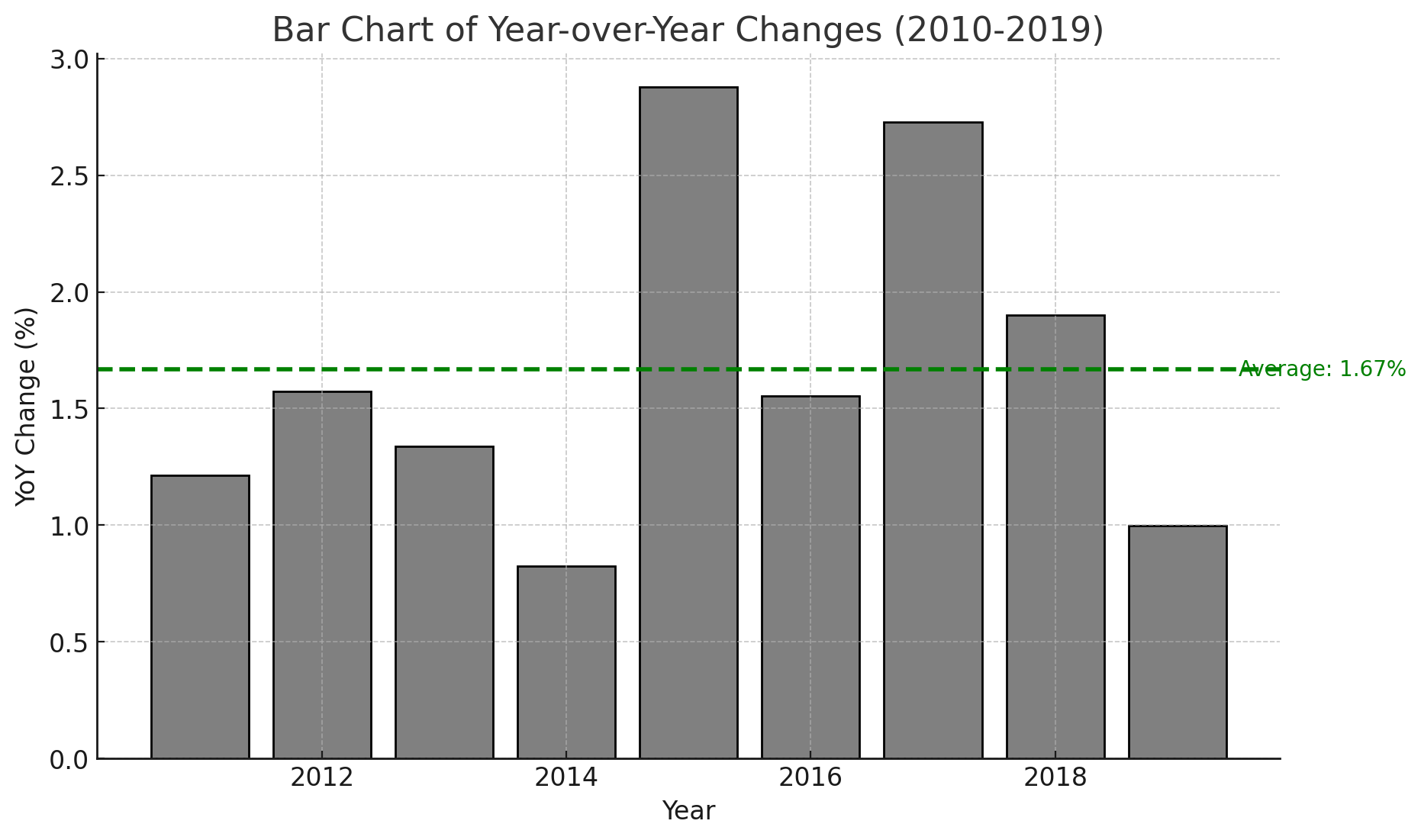

The current YoY demand growth is not significantly different from the average growth of the previous decade (+1.67%). However, the next few months are likely to show that this historical average is a thing of the past. It is possible that normalized demand growth after the COVID-19 pandemic will be half of what it used to be, or even lower.

-

Vincent

- July 19, 2023

- 9:35 pm

-

Vincent

- July 19, 2023

- 5:58 pm

Oil Intel

Oil products demand growth in various countries since Jun 2019

- China: 18.57%

- Vietnam: 15.66%

- India: 9.23%

- Indonesia: 5.21%

- Portugal: 3.27%

- Thailand: -0.37%

- United States: -1.18%

- Germany: -6.70%

- Mexico: -7.05%

- Turkey: -8.04%

- France: -8.73%

- Nigeria: -9.67%

- Sweden: -12.74%

China has been key to final product demand over the past years. Chinese demand growth has stalled during the Covid period though…

-

Vincent

- July 19, 2023

- 5:58 pm

-

Vincent

- June 13, 2023

- 9:32 am

Oil Intel

Saudis are at risk of trapping themselves into suboptimal production targets

Post China’s reopening, early signals indicate that the increase in oil demand may not meet the predictions made by OPEC and other agencies. If the rise in demand significantly falls short of 1 million barrels per day (Mbd), compared to the anticipated 1.5+ Mbd, then Saudi Arabia’s independent rebalancing efforts could turn out to be suboptimal.

Saudi Arabia perceives the current oil balances as temporary, expecting that strong demand growth will eventually result in a market shortage that only OPEC’s spare capacity can remedy. However, if non-OPEC production growth persistently surprises Saudi Arabia during a period of stalling demand growth, the nation, which has set a goal to boost its production from 9 Mbd to 13 Mbd within the next 3 to 5 years, could face a dilemma. It might be forced to choose between maintaining stable prices at current levels without reaching production targets, or achieving production targets but causing prices to drop to levels that would deter less competitive producers.

Saudi Arabia appears to maintain the belief that oil demand will correlate well with GDP and population growth, attributing any supply/demand weakness to cyclical factors. However, if this belief proves to be too optimistic and other more structural factors such as decarbonization and plateauing growth in China are influencing the situation, then Saudi Arabia’s production ambitions might only be realized through a strategy driven by market share.

It’s also worth noting that in the current market context, with Brent crude trading around $75 per barrel, every producer worldwide is satisfied with their earnings and would gladly accelerate production growth given the prospect of stable prices. So, in an era where oil demand growth is receding and production growth is plentiful, the oil market may need to identify only the most competitive producers. Price is generally a very effective tool for this purpose.

-

Vincent

- June 13, 2023

- 9:32 am

-

Vincent

- May 30, 2023

- 4:52 pm

Oil Intel

No visible changes in Russia oil exports and Iran seems to be getting a deal

Despite the expectations set by the OPEC+ agreement, there’s no definitive evidence to suggest that Russia has reduced its oil exports. In fact, there’s been a slight uptick in crude exports compared to the previous month, with no significant changes in storage levels.

This situation presents a complex challenge for key OPEC nations, especially considering countries like the UAE are keen to utilize more of their full production capacity. While it’s unlikely that OPEC will instigate a price war in response to Russia’s apparent bluff, reaching a consensus for additional production cuts may prove more difficult.

Additionally, the US appears to be nearing an agreement with Iran that could potentially lift sanctions and result in an increase of over 0.5 million barrels per day in Iranian crude exports. OPEC may need to reserve some flexibility to respond to this potential development. Therefore, we don’t anticipate further cuts from OPEC in the upcoming June meeting.

-

Vincent

- May 30, 2023

- 4:52 pm

End of content

No more pages to load