GZC Intel & Research

Oil Intel Playlist

Market Reports

Contact us

-

Vincent

- May 10, 2023

- 9:34 am

Oil Intel

Chinese oil products stocks keep on building…

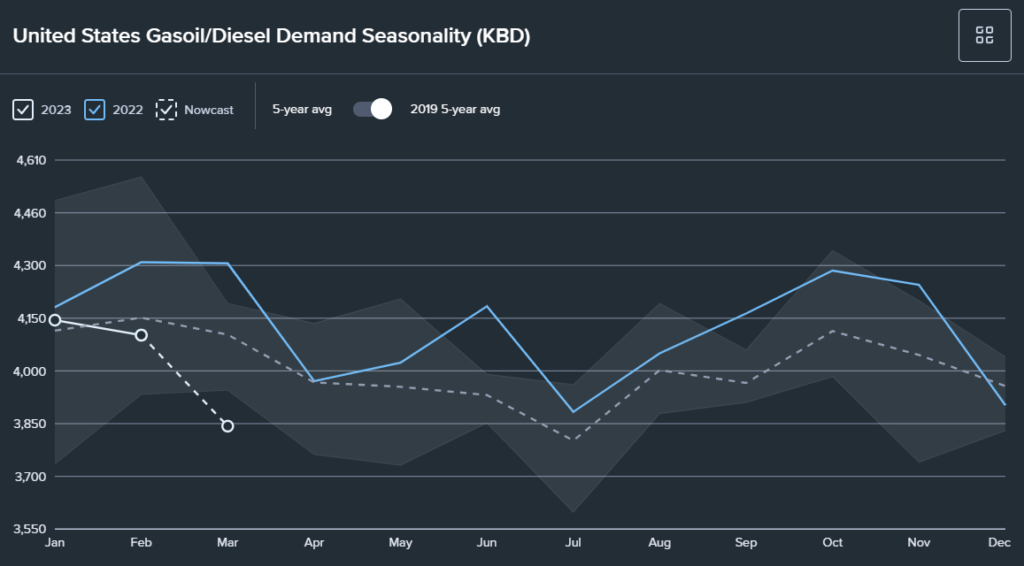

Stocks of Chinese oil products continue to accumulate at a pace of approximately 0.5Mbd even after reopening, with jet fuel stocks remaining unchanged.

Globally, inventory buildup ex-China is occurring at a similar rate of 0.5Mbd, albeit from a significantly lower starting point.

While global crude balances are projected to remain fairly tight from May 23 onwards, there’s a potential risk of refiners confronting the surplus capacity in the oil products market. This could eventually result in a decrease in crude oil demand.

Put simply, the current tightness in crude oil supply may be temporary, and it could become more pronounced if global growth weakens in the remaining part of the year.

-

Vincent

- May 10, 2023

- 9:34 am

-

Ed

- March 29, 2023

- 4:00 pm

-

Vincent

- March 16, 2023

- 10:51 am

Oil Intel

Is this time different for NOPEC?

A group of US bipartisan senators have re-introduced what has been known as the NOPEC (No Oil Producing and Exporting Cartels) bill in a revived attempt to push the producer group to rein in cutting oil production. Should the legislation clear the first hurdle of the Judiciary Committee and then both the Senate and the House of Representatives and be signed into law by President Biden the sovereign immunity OPEC members have enjoyed over past decades would be revoked and member countries and their national oil companies could face lawsuits over price fixing under US antitrust law. In the words of Mike Lee, the Republican senator of Utah “…OPEC continues to demonstrate its willingness to engage in illegal, anticompetitive, and extortionary means to enrich its members at the expense of consumers. It’s time to change that. I’m proud to cosponsor this legislation, which sends a clear message to the oil cartel that its days of illegally pricing and distributing petroleum products are numbered”.

There have been several attempts in the past 20 years to pass the legislation and to reduce the producer alliance’s control over oil supply, but these efforts have always faded. The timing of the latest endeavor is intriguing, curious, and maybe even unfortunate. It is intended against an inter-governmental organization, which is responsible for nearly 40% of the global oil output compared to around 12% from the US. The importance of OPEC and its allies will grow even further as the transition from fossil fuel to renewables hastens. The group’s market share will increase because Middle East oil producers have the lowest cost of producing a barrel and also pride themselves of providing the “lowest carbon” barrel of oil. The latest push comes after the US crude oil market has shed 40% of its value in the space of less than a year, and as domestic retail gasoline prices at $3.29/gallon are lower than a year ago, and well below last year’s peak of $4.84/gallon.

The legal aspect

Can the NOPEC bill be legally justified? In the US, possibly, only the antitrust law would need to be tweaked to authorize the Justice Department to bring lawsuits against OPEC+ members for antitrust violations. The bill would also clarify that “neither sovereign immunity nor the “Act of State” doctrine prevents a court from ruling on antitrust charges brought against foreign governments for engaging in illegal pricing, production and distribution of petroleum products”. It, however, contradicts a verdict from a US District Court, which concluded that OPEC consultations are, indeed, protected as governmental acts of state by the Foreign Sovereign Immunities Act, and consequently do not fall under the US competition law that governs commercial acts. Whether there is any basis for the US to exert its influence and control over sovereign nations’ natural resources is also an intriguing legal consideration.

=> Typically, attempts to pass legislation like this have been insignificant. However, given the current global tensions and China’s efforts to improve its diplomatic standing (such as the recent Saudi-Iran rapprochement), this proposed bill may have more relevance than it has had in the last two decades. Additionally, recent price controls imposed on Russia may have emboldened legislators to consider extending them to other nations. While the likelihood of NOPEC becoming law is still relatively low, it is no longer considered extremely improbable.

-

Vincent

- March 16, 2023

- 10:51 am

-

Vincent

- March 14, 2023

- 11:57 am

-

Ed

- March 10, 2023

- 2:37 pm

Macro Intel

Money supply in China diverging in a big way post Covid

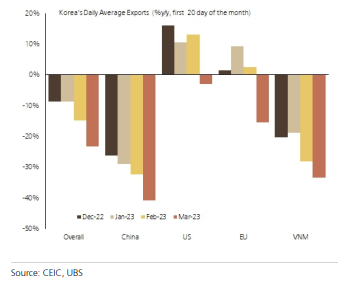

China M2 growth is accelerating again since the reopening end of last year as low inflation allows for fiscal and monetary expansion. Meanwhile, rising inflation and monetary tightening in the US and Europe are leading to negative money supply growth in the US and rapid deceleration in Europe following their massive Covid stimuli. This divergence in money supply growth is likely to continue to weigh on the renminbi.

-

Ed

- March 10, 2023

- 2:37 pm

End of content

No more pages to load